Updated: February 12, 2017

It’s now that time, time to start paying off your student loans. Many of us didn’t think twice about these loans while we were still enrolled in college and didn’t fear the consequences or think about the commitment of the loans when we accepted them before the start of each semester, and not that we had much of a choice we had to pay for the cost of tuition somehow. I just started to pay off my student loans and most of them are through Nelnet.

Related Articles:

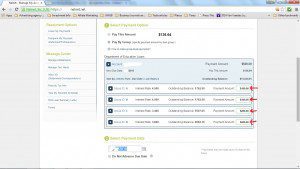

In my Nelnet account, my student loans are categorized in groups by the year in which I took them out. I have four groups, Group A, Group B, Group C, and Group D. My student loans are categorized by the most recent to oldest. So “Group A” being the most recent set of loans taken out (or loans taken out my senior year) to Group D being my oldest loans taken out (loans taken out my freshmen year).

Nelnet Loan Groups

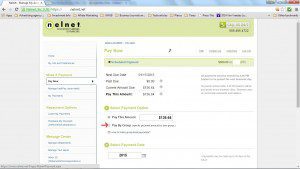

Currently I began making payments on my Nelnet student loans, which has an outstanding balance of over $13,000. These loans gain interest every day and I’ve decided to begin paying off more than the minimum monthly payment each month. I do this by clicking “Pay By Group” instead of “Pay this Amount“.

I’m then able to select the individual amount I would like to pay for each student loan. Normally you would want to pay off the student loan with the highest interest first. In my case I’m putting more money towards the loans in Group A and Group B because their interest rates are higher than Group C and D.

Save Money

You’ll have money in the long run by paying off your student loans sooner rather than later because you won’t be paying as much interest on your student loans.

Get Help

If you find yourself struggling to make payments on your student loans or are missing payments completely, seek professional help immediately. If you delay getting help, you’re only putting more stress on yourself and your student loans will continue get worse and quickly get out of control.

There are excellent debt relief programs and credit counseling agencies that specialize in helping people get out of student loan debt. You can seek help and receive friendly assistance from professionals at companies like CuraDebt, National Debt Relief, Credit Assistant Network, American Debt Enders, and Ovation Credit Repair.

If you’re too embarrassed or ashamed to seek help, don’t be! The the professionals who specialize in debt relief help people like just like you everyday and won’t judge you one bit. Your situation is probably very minor compared to other’s they work with. They want to help you and the sooner you get help the easier it’ll be to find a solution.

Related Articles:

- The CuraDebt Review on Debt Relief & Debt Settlement

- How to Settle Your Debt – National Debt Relief Review

- Credit Assistance Network Review – Improve Your Credit

Is it OK to reference this article in an ebook I’m working on?

Absolutly!

hello, I’ve experienced the same and i’m glad you’ve shared it. thoughtful article you’ve written there.